Spring is shaping up to be an active season for Australia’s property market. Rising demand, limited supply, and government incentives are creating both opportunities and challenges for buyers and investors. At Key 2 Wealth, we help our clients navigate these conditions with insights and strategies to make informed property decisions.

Overview

- Strong Monthly Growth:

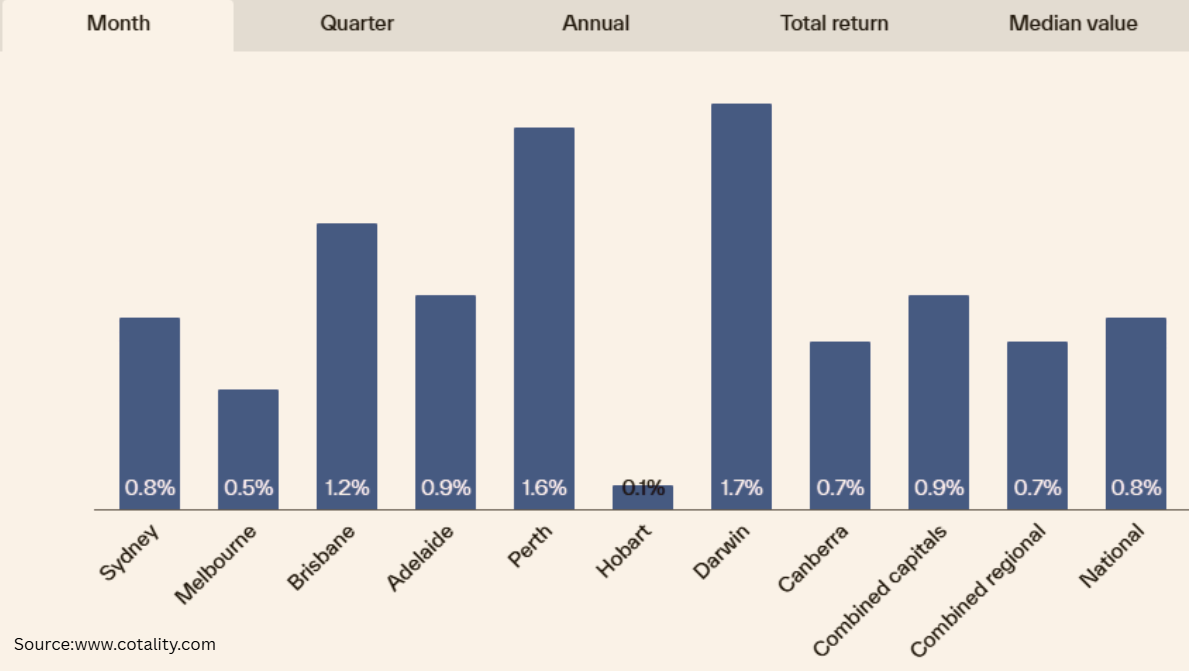

September delivered the strongest monthly rise in national dwelling values since October 2023, with the Cotality Home Value Index (HVI) increasing 0.8%.

- Record-Low Listings Driving Prices:

From Darwin to Brisbane, advertised stock levels are well below average, with Darwin down 53%. Buyer demand continues to surge.

- First-Home Buyers Face Competition:

The expanded Home Deposit Guarantee is helping first-home buyers, but nearly half of all suburbs are now under new price caps, intensifying competition in a tight market.

Australia’s housing markets are gaining momentum as we move further into spring. September recorded the strongest monthly increase in national dwelling values since October 2023, with the Cotality Home Value Index (HVI) rising 0.8%. Capital cities led this growth, with property values increasing 0.9% over the month.

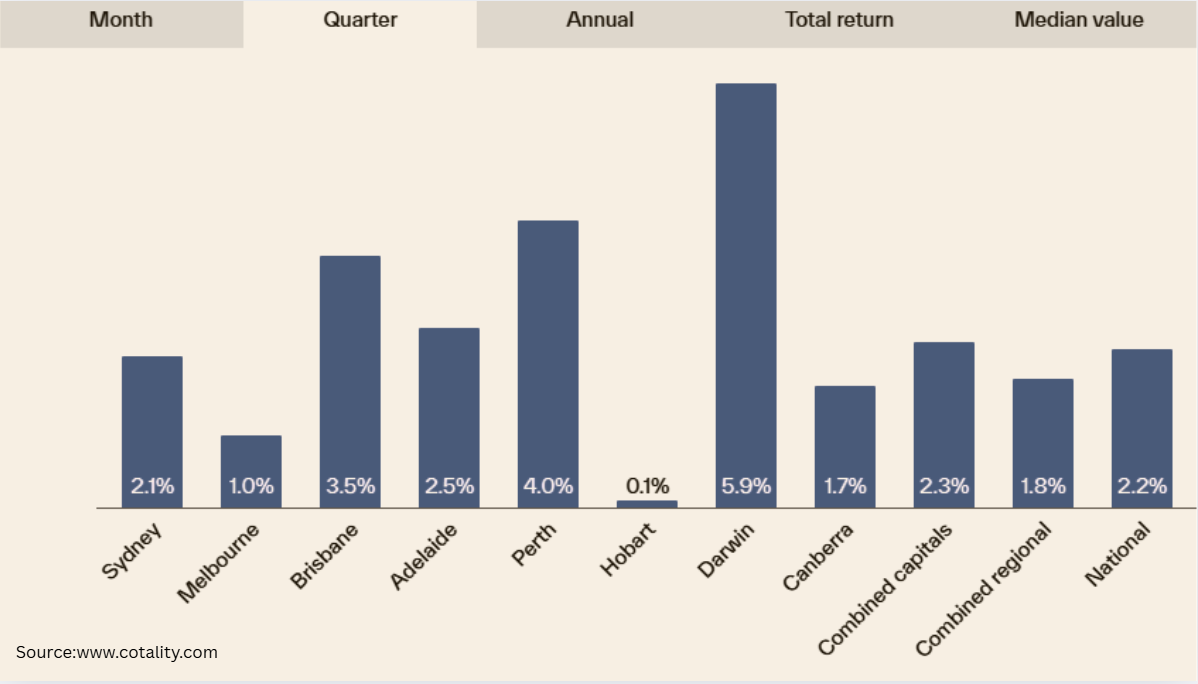

Quarterly, the national HVI climbed 2.2%, up from a 1.5% increase in the June quarter and double the 1.1% growth seen in the March quarter. In dollar terms, this represents an $18,215 increase in the median dwelling value over the September quarter.

Growth has become broad-based, with all capital cities and regional areas recording increases over the month, quarter, and past 12 months. However, the pace of growth is varying between cities.

- Perth and Brisbane are leading the larger capitals, with values up 4.0% and 3.5% respectively for the September quarter, largely driven by the unit market.

- Darwin is experiencing even stronger growth, with property values jumping 5.9% over the past three months.

At Key 2 Wealth, we help buyers and investors navigate Australia’s property market, identifying opportunities and making informed decisions. Working with an experienced property buyer agent ensures you receive personalised guidance, expert advice, and support throughout the entire buying process.

September 2025 Housing Market Snapshot

Monthly Home Value Growth – September 2025

The Cotality Home Value Index (HVI) shows how dwelling values changed across Australia’s cities and regions in September 2025:

Property owners in high-growth markets like Darwin, Perth, and Brisbane are seeing strong value gains, while those in slower-growth areas can plan strategically for future growth opportunities.

September 2025 Quarterly Home Value Growth

Over the September quarter, dwelling values across Australia showed solid growth, led by Darwin, Perth, and Brisbane:

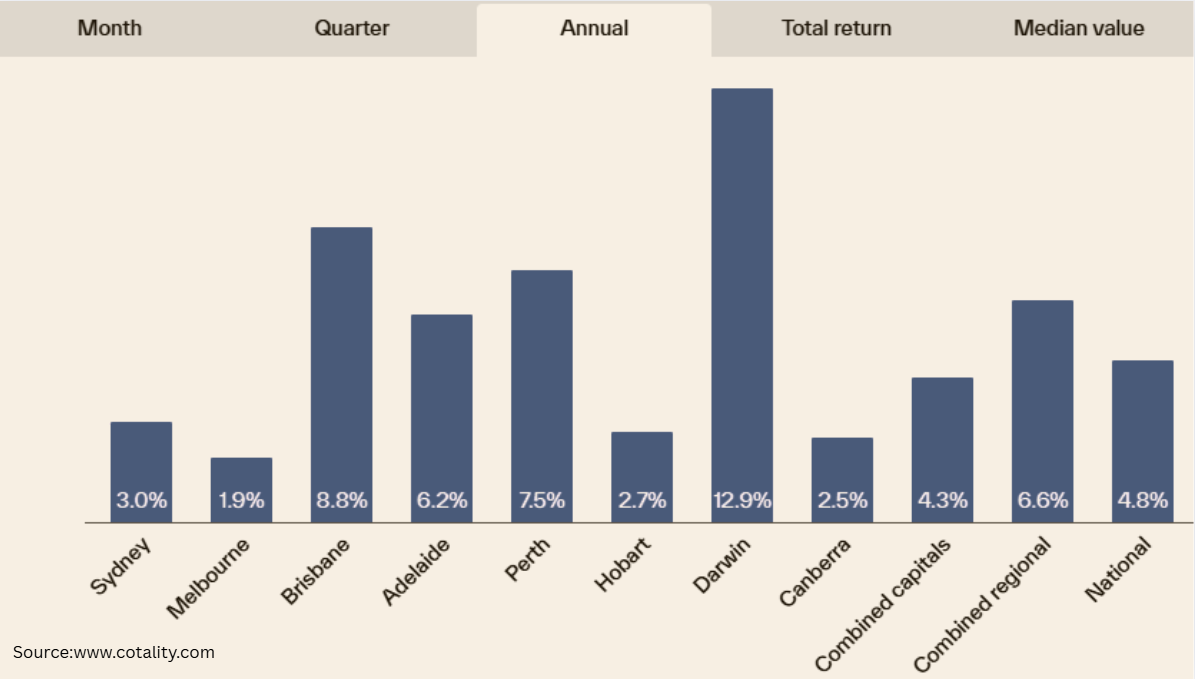

Annual Housing Market Snapshot – September 2025

Over the past year, Australian property values have risen across all major cities and regions. Darwin, Brisbane, and Perth led the growth, showing strong market momentum, while Melbourne, Hobart, and Canberra recorded more moderate increases.

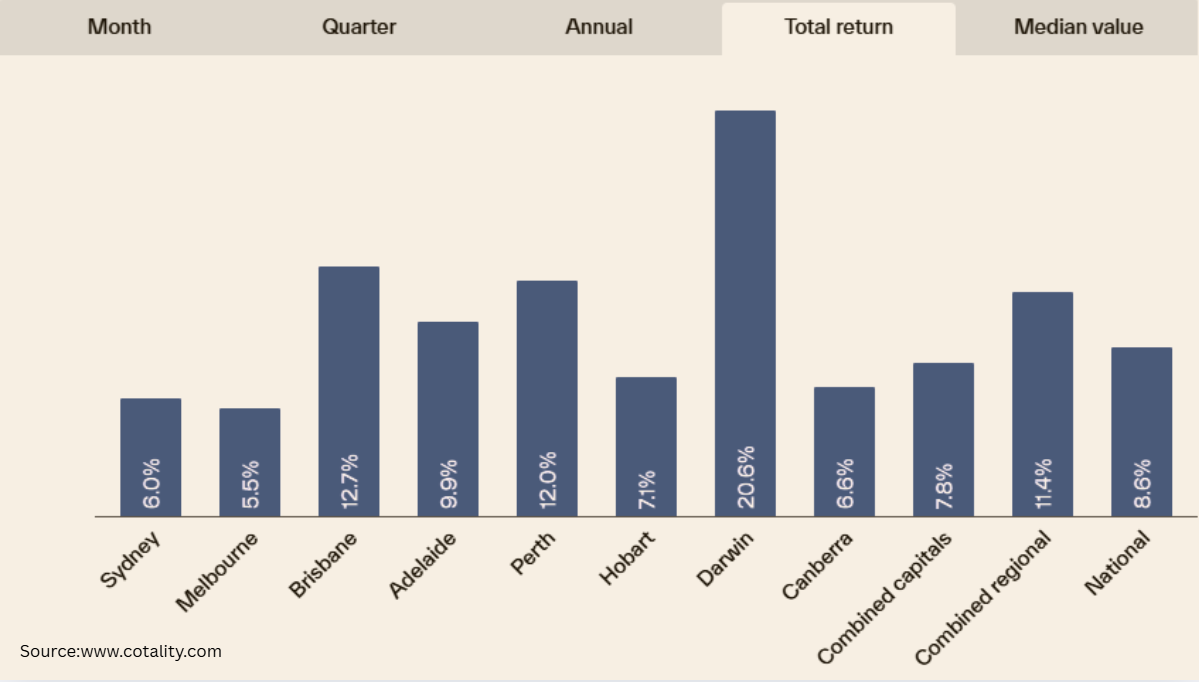

Total Property Returns – September 2025

Over the past year, total returns from Australian property have been strong across all regions. Darwin, Brisbane, and Perth delivered the highest returns, reflecting robust capital growth and rental income, while slower returns were seen in Melbourne, Sydney, and Hobart.

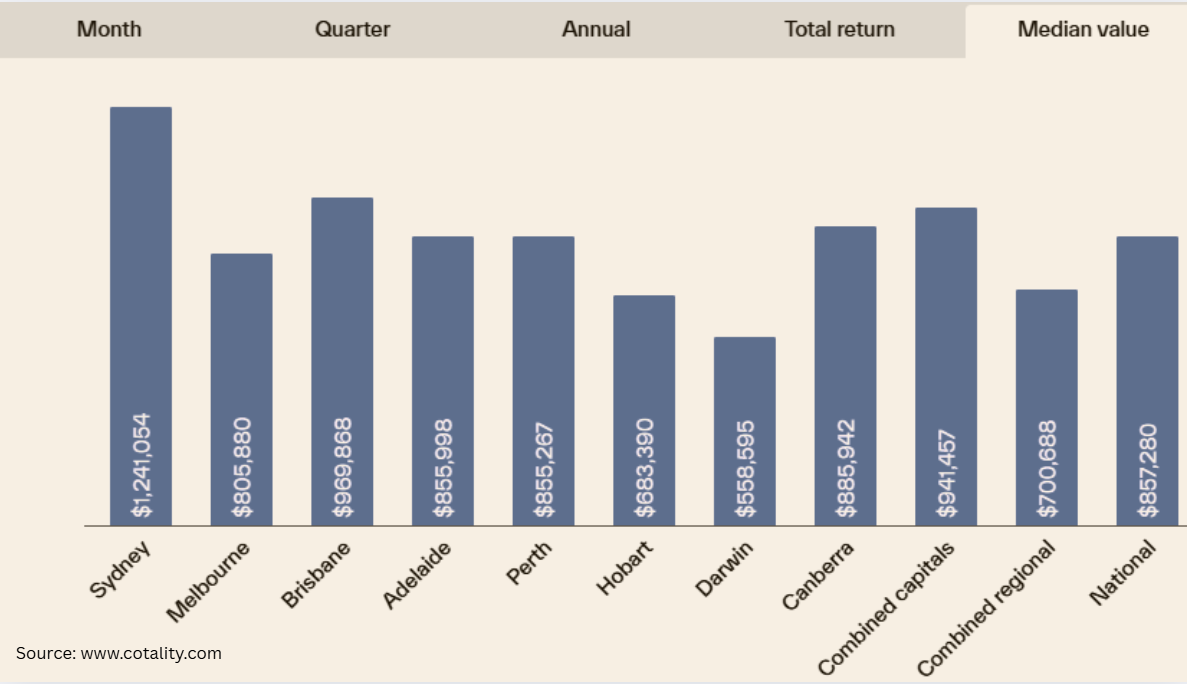

Median Property Values – September 2025

Median property values have continued to rise across most capital cities, with Sydney leading as the highest-priced market. Brisbane and Perth show strong mid-range values supported by steady buyer activity, while Darwin and Hobart remain among the most affordable capitals. Overall, the data reflects ongoing demand and confidence across the Australian housing market.

Australian cities continue to face a significant shortage of homes for sale. In Darwin, listings are about 53% below average, Perth is down 45%, and Brisbane has 31% fewer homes than usual. Despite this limited supply, quarterly home sales are tracking above average, highlighting the gap between strong demand and available properties.

Across most cities, house values are increasing faster than units, with capital city houses up 2.4% and units up 1.7% in the September quarter. Brisbane is an exception, where unit values have consistently risen faster than houses over the past seven quarters due to ongoing supply shortages. Perth and Hobart have also seen periods where unit prices outpaced houses, though this trend has been less consistent.

Home values are rising across all price tiers, with the strongest growth observed from the lower quartile up to the middle segment of the market. Lower interest rates and increased borrowing capacity are helping buyers move into slightly higher-priced properties. In the combined capitals, lower-quartile values grew 2.6%, middle-tier values rose 2.7%, and upper-quartile values increased 1.8% over the quarter.

Listings remain below average across every capital city, further driving home value growth. Over the four weeks to late September, listings were 18% below the five-year average, while quarterly sales activity was 7.3% above the five-year average. This imbalance between supply and demand has strengthened selling conditions, with auction clearance rates holding around 70% since mid-August, up from roughly 63% in the June quarter and 62% in the three months to March.

If you’re planning to buy property in Melbourne, Sydney, or anywhere across Australia, working with an experienced buyers agency can make all the difference. Key 2 Wealth, a trusted and expert buyers agency, offers personalised guidance, in-depth market insights, and professional support to help you find the right property and secure the best price. Ankit Tailor, our dedicated buyers agent, ensures every client receives expert advice and a smooth, successful buying experience.

Contact us today:

Phone: 0430 777 184

Email: info@key2wealth.com.au

Follow Ankit Tailor on Facebook, Instagram, LinkedIn, and Twitter for updates, tips, and property insights.