table of contents

Thinking of selling your investment property, shares, or other assets? Many Australians do not realise that a significant portion of their profit could go straight to the tax office if they are not careful. Capital Gains Tax (CGT) can reduce your returns considerably, but with the right knowledge and planning, you can minimise your liability and keep more of your hard-earned money.

As a professional buyers agent, we help clients find the right property and guide them through strategies to reduce CGT and maximise investment returns. In this blog, we will cover everything you need to know about CGT, including how it is calculated, which assets are affected, and strategies to reduce your tax liability.

This guide explains how CGT works, how a CGT calculator helps, and why combining the right tools with expert advice from Key 2 Wealth can significantly improve your property outcomes.

What Is Capital Gains Tax (CGT)?

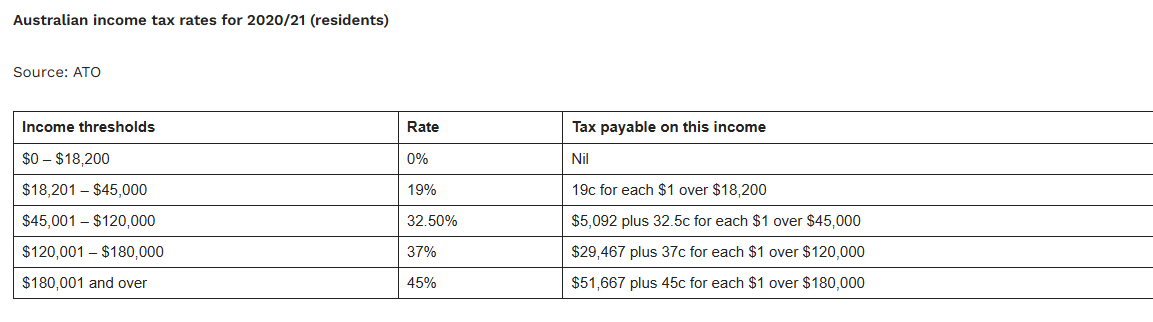

Capital Gains Tax is the tax applied to the profit made when you sell a capital asset for more than its purchase price. In Australia, CGT is not a separate tax, instead, the capital gain is added to your annual income and taxed at your marginal rate.

Assets commonly subject to CGT include:

- Investment properties

- Shares

- Commercial property

- Vacant land

Your main residence is generally exempt from CGT, provided it meets eligibility criteria. However, if the property was rented out or used for income-producing purposes, partial CGT may apply.

Understanding CGT early especially before buying is where expert guidance from Ankit Tailor as a professional property buyers agent becomes invaluable.

How a Capital Gains Tax Calculator Works

A Capital Gains Tax Calculator provides an estimated CGT amount by analysing several key inputs:

- Purchase Price – What you originally paid for the asset

- Sale Price – The final selling price

- Associated Costs – Stamp duty, legal fees, renovations, agent commissions

- Ownership Period – Assets held for over 12 months may qualify for a 50% CGT discount

- Taxable Income – Determines your marginal tax rate

Once entered, the calculator estimates your capital gain and potential tax payable. This allows property owners to model different scenarios before selling.

Clients working with Key 2 Wealth often use CGT calculators alongside strategic advice to assess the long-term tax impact before purchasing or selling an investment property.

Why You Should Use a CGT Calculator Before Selling

Using a Capital Gains Tax Calculator early can help you:

- Forecast tax obligations

- Decide when to sell for maximum tax efficiency

- Plan cash flow around settlement

- Avoid underestimating tax liabilities

For example, holding an investment property for more than 12 months usually unlocks a 50% CGT discount for individuals. Timing your sale correctly can make a substantial difference to your final profit.

Example: Calculating CGT on an Investment Property

Imagine purchasing an investment property for $550,000. After holding it for several years, you sell it for $780,000. After accounting for purchase costs, renovations, and selling fees, your net capital gain is $180,000.

Because the property was held for over 12 months, you may qualify for the 50% CGT discount, reducing the taxable gain to $90,000. That amount is added to your annual income and taxed accordingly.

This example shows why CGT calculators are essential, and why expert guidance from Key 2 Wealth helps ensure investors understand the full financial picture before selling.

How Buyers Agents Help Reduce CGT Risk

A professional buyers agent does more than find property. At Key 2 Wealth, strategic planning focuses on long-term outcomes, including CGT exposure.

For First Home Buyers

A First Home Buyers agent ensures buyers understand how future rental use or resale could impact CGT, even if the property starts as a principal residence.

For Investors

A buyers agent for investment property evaluates:

- Growth-driven locations

- Holding strategies

- Long-term tax efficiency

By choosing the right property from the start, investors can minimise CGT while maximising capital growth.

Tips to Better Manage Capital Gains Tax

1. Hold Assets Strategically

Holding property for more than 12 months can significantly reduce CGT through the discount method.

2. Keep Accurate Records

Maintain documentation for all purchase costs, renovations, and selling expenses to ensure accurate CGT calculations.

3. Get Expert Advice

By working with tax professionals, a buyers agent helps clients make well-structured property purchase decisions from the outset.

4. Use Tools with Strategy

CGT calculators provide estimates, but combining them with personalised advice delivers better long-term results.

Why Choose Key 2 Wealth

Key 2 Wealth is a trusted buyers agency offering tailored support for:

- Home buyers

- First-time buyers

- Property investors

- Long-term wealth builders

By integrating market insights, tax considerations, and strategic planning, Key 2 Wealth helps clients make confident property decisions backed by data, not guesswork.

Have questions or ready to take the next step? Contact us today.

Get in touch with Key 2 Wealth today and take control of your property journey. Whether you’re buying your first home or building a strategic investment portfolio, our expert team is ready to guide you with clarity and confidence. Reach out now to start a conversation that turns informed decisions into lasting results.

Phone No: 0430 777 184

E-Mail: info@key2wealth.com.au

Follow Ankit Tailor across Facebook, Instagram, LinkedIn, and Twitter for regular updates, expert advice, and valuable property insights.